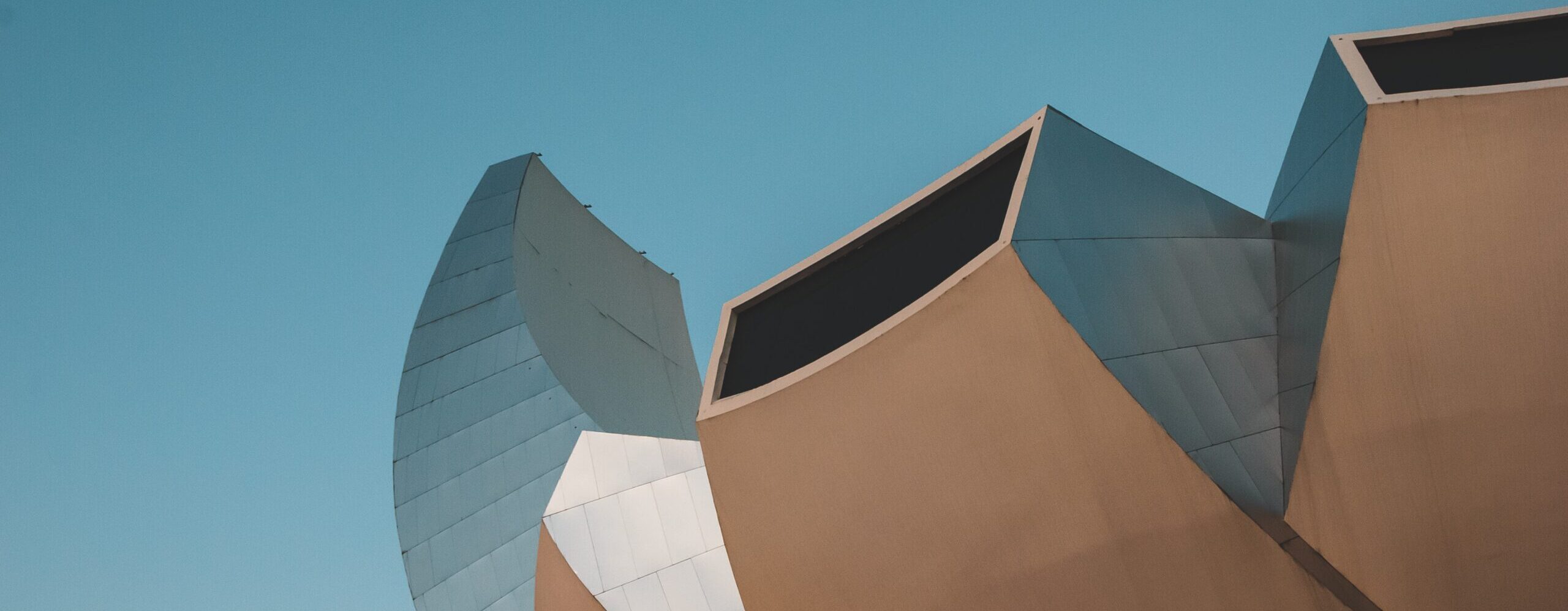

We unlock growth to create great companies.

At NextBold Capital, we are doing more than investing in small & mid-cap companies — we are shaping the future of Southeast Asia.

We’re redefining private equity investing in Southeast Asia

NextBold Capital invests capital & know-how in Southeast Asian small & mid-sized companies with high growth outlooks.

We’re redefining private equity investing in Southeast Asia.

NextBold Capital invests capital & know-how in Southeast Asian small & mid-sized companies with high growth outlooks.

We serve small & mid-cap growth & transformation needs

Scale-up capital

We partner with entrepreneurs challenging the status-quo and building tomorrow’s success stories by providing access to capital and operational expertise.

Growth, Transition & Turnaround

We partner with businesses facing a succession gap, power growth companies who do not qualify for typical Growth Capital or Private Equity and deliver operational improvement to mid-sized companies facing challenges.

Providing tailored solutions to SMEs’ unique challenges

Growth Capital

We provide capital & hands-on support to small & mid-sized companies with a clear product-market fit and an defensible edge in the marketplace.

Succession Buyouts

We partner with families facing succession gaps to acquire stakes in, build capabilities & grow their businesses into long-lasting, growth corporations.

Special Situation Partnerships

We partner with underperforming companies and provide an engine of growth by means of transformation, skillset building and repositioning.

OUR STRATEGIES ⸻

Private equity solutions tailored to unique regional challenges

Growth Capital

We provide capital & hands-on support to small & mid-sized companies with a clear product-market fit and a defensible edge in the marketplace.

Succession Buyouts

We partner with families facing succession gaps to acquire stakes in, build capabilities & grow their businesses into long-lasting, growth corporations.

Special Situation Partnerships

We partner with underperforming companies and provide an engine of growth by means of transformation, skillset building and repositioning.

OUR APPROACH ⸻

More than capital: we deliver sustainable value creation

Our value creation process starts before an investment is made and continues throughout the lifetime of an investment.

We partner with management teams to identify, execute & sustain results, delivering value across key phases of deal lifecycle.

We focus on underserved growth & turnaround needs

Succession Gap

We provide exits to small & medium businesses owners facing a succession gap or wanting to cash out.

Growth Opportunities

We power growth companies who do not qualify for Venture Capital, Growth Capital or Private Equity.

Turnaround Situations

We focus on medium sized companies with operational improvement potential and who are facing challenges.

Southeast Asian markets are what we understand

12% of the global population lives here

Southeast Asia and ANZ are home to approximately 775 million people, expected to grow at +1.4% p.a. until 2050.

Economies that learnt to be resilient

Southeast Asia has grown at an average of 5.4% p.a. for the past 20 years and is expected to keep growing at similar rates until 2040, powering through even during pandemic years.

Business fabric with a global mindset

The region ranks 4th in global exports, having doubled its exports in the past 20 years, and is expected to grow 7% p.a. until 2030.

Relatively stable & seeing de-regulating trends

Most Southeast Asian markets rank high vs other emerging markets’ in The Economist rankings and have been ongoing a process of deregulation across most industries.

We’re an operational capital firm, with a unique approach

Entrepreneurially managed

We take a hands-on approach to our investments, injecting drive, knowledge and a bias for action into our companies.

Data & insights driven

We approach decision-making using data as a tool to support intuition & insights and unlock trends we might be missing.

Accountability centric

We enable visibility on objectives, capital allocation and financial performance to leadership & investors we work with.

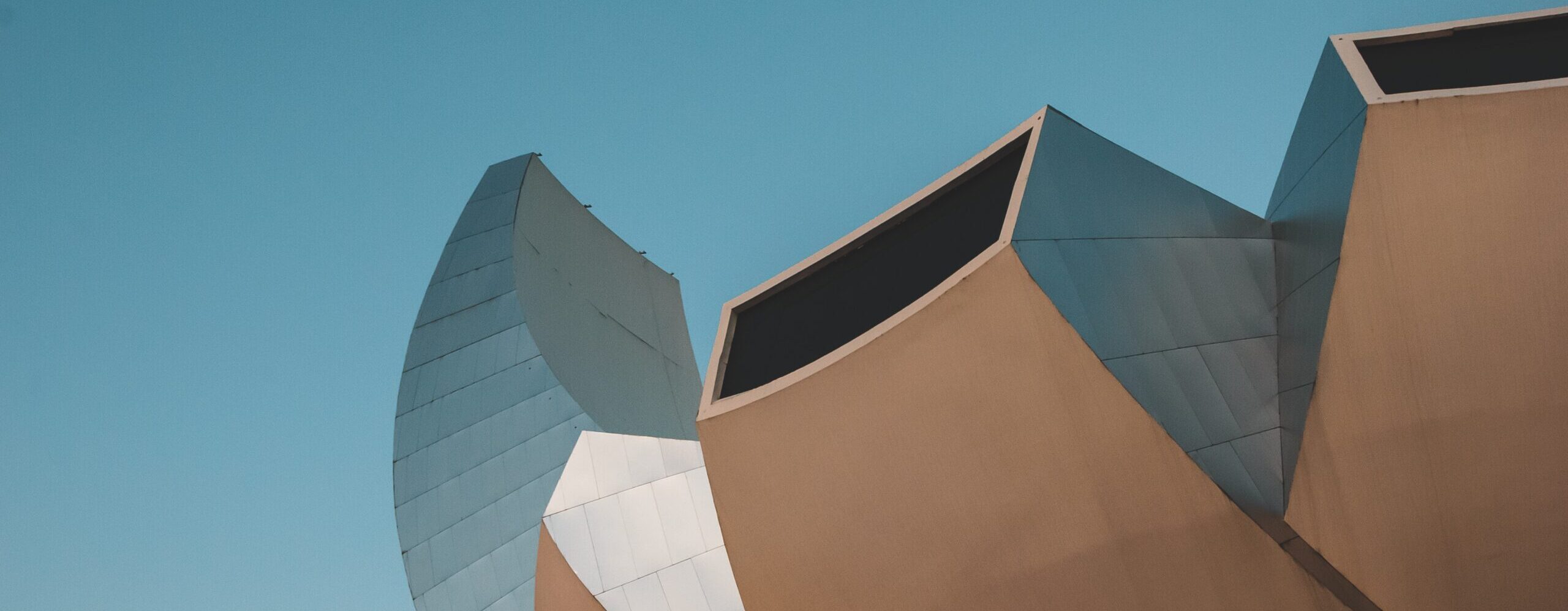

INVESTING WITH US ⸻

Leveraging vision & discipline to create exceptional results.

NextBold Capital provides a truly managed risk exposure to exciting but uncertain private markets in Southeast Asia.

The result: capital preservation through strong, positive asymmetric risk-returns.